HELLO TO MY URBAN PALS, COUNTRY COUSINS AND MOUNTAIN MATES ! THE PIG HAD A SPECTACULAR DAY TODAY ! HE RECEIVED NEWS THAT HIS MOTHER-IN-LAW, SUEY THE SOW, CAN'T MAKE NEXT MONTHS REGULAR VISIT. DAG NABIT !! THE PIG IS ALL BROKE UP. HE WILL RECOVER THOUGH.......

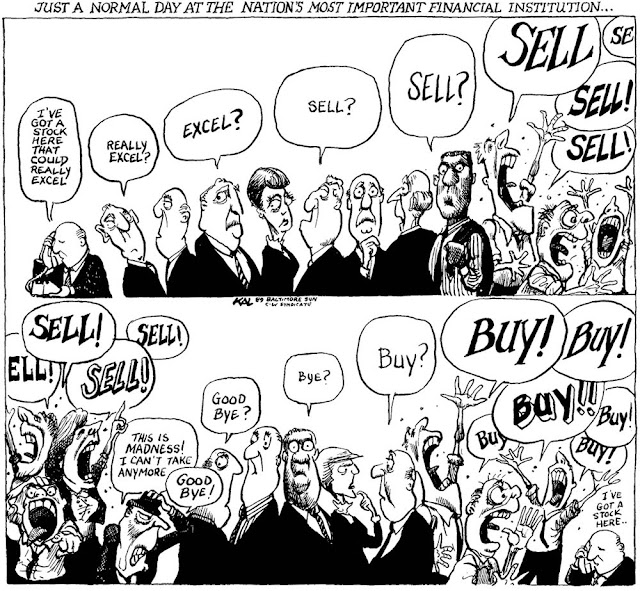

SERIOUSLY ANOTHER INTERESTING DAY ON THE MARKETS AND CALLS FOR A NEW AND STRONG CORRECTION CAME A BIT LOUDER. THE PIG NEVER WORRIES ABOUT THE VOCAL MINORITY, WHAT HAPPENS HAPPENS AND THE PIG NEVER SWEATS ABOUT IT. ITS POINTLESS, BUILD YOUR ASSET BASE AND PROTECT YOUR PROFITS AND YOU WILL NEVER HAVE TO WORRY ABOUT ANOTHER CORRECTION AGAIN.

THE PIG PREACHES...POSITION+PATIENCE=PROFITS..

ON WITH THE SHOW....

(BY THE WAY..SEE WHAT AEX.V DID TODAY ????...THE PIG CALLED IT ON JAN. 1ST AT .20))

AAU.V....SCANNED VERY WELL TONIGHT. HIGH VALUES IN 9 OF 10 SECTORS AND STRENGTH ACROSS THE BOARD. SOME BIG NEWS OUT TODAY. LEADS THE PIG TO BELIEVE THE PROMO WILL BE ON. MAYBE A GAP UP TOMORROW. A DOUBLE OR TRIPLE MAY BE IN THE WIND HERE AS THE COMPANY MOVES THROUGH THE SPECULATION CYCLE TO ACTUAL DRILLING STATUS. MAY BE A GOOD SHORT TO MEDIUM TERM BUY......

BRG.V....REMEMBER WHAT THE PIG SAID ABOUT PATIENCE AND ACCUMULATION ETC ETC......WELL IT APPEARS THIS ONES DOING BOTH......MEANING BEING PATIENTLY ACCUMULATED. ANOTHER THING THE PIOG SAID, FOLLOW THE PROS AND WHAT THEY DO...............COULD BE PORKLY PROFITABLE IN THE MEDIUM TERM........

MEX.V....FAR BE IT FOR THE PIG TO BE A FINANCE GUY. BUT WOULD YOU NOT THINK A MASSIVE PROMO IS COMING TO A STOCK THAT HAS PEOPLE CRAMMIN' IN THE DOORS TO GET INTO A PP ?? THE PIG THINKS SO........MAYBE WE COULD GET IN FOR A FEW TOO !!!

Trading Day: TSX rebounds on growing factory activity

Monday, February 1st, 2010 | 6:01 pm

Canwest News ServiceVANCOUVER – Canadian stock markets staged a rebound on Monday, recovering nearly all the losses of the previous week, after manufacturing activity in Europe and the U.S. grew more than expected in January.

The S&P/TSX metals and mining index jumped 5.25 per cent, helping drive the broader S&P/TSX Composite index up 223.24 points, or two per cent, to 11,317.55. The S&P/TSX Venture composite added 17.79, or 1.2 per cent, to 1,509.94.

European manufacturing rose at the fastest pace in two years, while in the U. S. factory activity grew the most since August 2004. The brisk recovery, coupled with a $3.8-trillion U.S. budget proposal for 2011 from the Obama administration, sparked selling in the U.S. dollar, boosting commodity prices.

Gold settled above $1,100 US an ounce for the first time in seven trading sessions, jumping $21.20, or two per cent, to $1,105 US an ounce for the April contract. March silver added 47 cents, or 2.9 per cent, to $16.66 US. Copper bounced 3.1 per cent from a two-month low, settling at $3.0835 US a pound after an intraday jump of nearly 10 cents. Vancouver-based Red Bank Mining, operator of two gold mines in Africa, saw its shares rise $1.38, or 8.6 per cent, to $17. 45. New Gold, developer of the New Afton copper-gold project near Kamloops, climbed 26 cents, or six per cent, to $4.55. Vancouver-based Teck Resources gained $1.69, or 4.8 per cent, to $36.70. After trading as high as $42.78 on Jan. 11, its highest level since August 2008, Teck closed Friday at $35.01, for a pullback of 18 per cent.

The March crude contract added $1.54, or 2.1 per cent, to $74.43 US a barrel, while March natural gas climbed 23.1 cents, or 4.5 per cent, to $5.362 US per million Btu.

Cenovus Energy, the integrated oil producer spun off from EnCana at the end of November, gained $1.18, or 4.8 per cent, to to $25.89. Canadian Oil Sands, the biggest stakeholder in the Syncrude heavy oil project, climbed 97 cents, or 3.5 per cent, to $28.71.

Shares of Khan Resources jumped 14 cents, or 16 per cent, to $1.00 after China's national nuclear agency offered $56.5 million, or 96 cents a share for the 58-per-cent owner of the Dornod uranium project in Mongolia.

Cinram International Income Fund plunged $1.65, or 60 per cent, to C$1.16. The DVD distribution outsourcer said it will lose its biggest customer, Warner Home Video at the end of July. Cinram relied on Warner for 28 per cent of sales last year. The company employs 17,000 people making DVD's, but video downloads are eating into its business. Shares of Richmond-based Ritchie Brothers continued lower Monday, shedding 21 cents, or 0.9 per cent, to $22.27. Former CEO Dave Ritchie gave Ritchie's a vote of confidence Monday, hiring the firm he founded to auction his 220-foot luxury mega-yacht to the highest bidder. The sale is slated for March 30 in Grand Cayman. The vessel can accommodate the skipper and his mate, 12 guests, and 19 crew on six decks.

On Wall Street, the Dow Jones Industrial Average gained 118.20 points, or 1. 2 per cent, to 10,185.53, the S&P 500 climbed 15.32, or 1.4 per cent, to 1,089. 19, and the Nasdaq composite added 23.85, or 1.1 per cent, to 2,171.20. Amazon. com fell $6.54, or 5.2 per cent, to $118.87, erasing all last week's gains. Amazon agreed to publisher Macmillan's demand for a 30 to 50-per-cent price hike for electronic books on its Kindle reader, reflecting competitive pressure from the new Apple iPad. Shares of Barnes and Noble jumped $3.20, or 18 per cent, to $21.20 in late trading after supermarket mogul Ron Burkle offered to double his stake in the company to 37 per cent.

Jan 26 2010 11:12AM

The Watched Pot...

Doubt that growth of the new creditor economies is the real driver for the metals market is waning ever more rapidly. Not everyone will view that as a good thing, but most will now look to China for the moment and to the other big areas of expansion in due course for cues on which direction the sector will take. That, and recognition of very real supply constraints, has been the HRA stance for most of this century. So it’s time for us to do the worrying.

Last month we told Dispatch readers that we don’t view China’s resurgent economy as abnormal given its high savings rate, and that concern should be more focused on overheating of the economy. China’s imports were up by 56% y/y in December, which is mirrored by a gain of almost that much for the year of iron ore import on a tonnage basis. It’s true that China’s exports are also finally growing again with a 17% y/y gain in December, which puts China ahead of Germany as the biggest exporter on the planet. Chinese auto sales nearly doubled last year, making them part of the biggest car market in the world, which 18 months ago wasn’t expected to happen before the middle of this decade.

It is also true that some Chinese housing markets saw 50% price gains. We aren’t amongst those who call this a bubble, at this point, since the supply excesses can be taken up eventually by the influx from the countryside. Some price spurts are to be expected in a rapidly urbanizing economy. However, spurts are the leading edge of spikes, and it’s the other edge that hurts.

China is shifting to a tightening policy, which is wise before the housing and commercial space markets get any more heated. It is time for a check on the allocation of capital. Like other economies, China has a large dollop of government incentive charging it. Unlike most, it probably didn’t need as much stimulus as was supplied and, equally important, it doesn’t have a big government debt that requires things like tax holidays be rescinded or new taxes invented to cover it. The mood shift required to push housing prices that fast is the real worry. That could probably use some grounding, before it gets tied.

There has also been some heat under a series of new exploration deals coming to market, particularly if they encompass the building materials copper and iron. Some are doubling before the due diligence can be finished. That doesn’t necessarily mean they are getting overvalued, and on the whole we like it when juniors are moving higher. It’s also true that many of last year’s big gainers have gone into neutral, so this has not been exuberance at play so much as a desire for newness. But, see above for comments about spikes and edges.

Over the next ten days Vancouver will host three separate conferences about resources and investment therein, and some of the early year enthusiasm relates to expectation of what may come from those gatherings. We will be looking for new deals as well looking over ones already on the list. Both will be part of a sorting process over the first half of this year. We admit to a quandary about copper’s dual gains for price and warehouse stocks, but can’t see changing our stance before the red metal changes its capricious ways. We’ve been teased before.

David Coffin and Eric Coffin

No comments:

Post a Comment