SO GOES THE MARKET AND SO GOES THE RUMOUR MILL. THE PIG WILL HANG ON TO HIS HOLDING IN GPG.V. NEWS OUT TODAY WAS ENLIGHTENING EVEN IF IT DID CAUSE LIGHTNING. THE MARKET SAW IT AS A BIT OF A BUST AND SOLD IT OFF BASED ON THAT. JUST GOES TO SHOW YOU, AFTER ALL THE CHECKS AND BALANCES WE LIKE TO FOLLOW BY YOU CAN'T PREDICT THE TIDES OF THE MARKET SENTIMENT. AS THE PIG STATED A FEW DAYS BACK, WE ARE AFTER ALL, SLAVES TO THE MARKET WHIMS.

SO WITH AAA.V, YLL.V, AND A COUPLE OF OTHERS LIKE GPG.V, THEY GO TO THE MEDIUM OR LONG TERM HOLD SECTION OF THE FILE CABINET, AND WE CONTINUE HUNTING FOR THE "NEXT" ONE.. THE WAS GOING TO TAKE A RUN AT WOO.V TODAY BUT OPTED FOR A FEW STICKS OF VAX.V. THE PIG WILL SEE WHAT THE HUB BUB IS AND MAY SELL INTO STRENGTH OR UP TO NEWS. MEANWHILE WE CONTINUE THE HUNT.

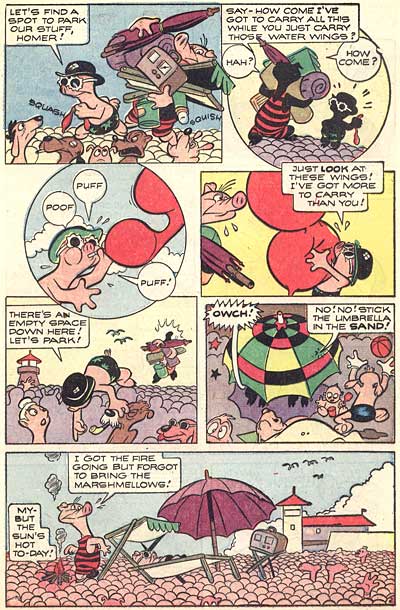

ON WITH THE SHOW...

EGM.V....A PREVIOUS PIG PICK AND STARTING TO LOOK LIKE A PROFITABLE ONE. THE PIG BRINGS IT BACK DUE TO A TOP 3 SCAN "AGAIN" AND A SPIKE IN THE NET CAPITAL INFLOW AREA. STRONG SENTIMENT INDICATORS STILL AND SOME DECENT MOVING AVERAGE VALUES. WHATS THE TOP SIDE.......

SRI.V..MOMENTUM TURNAROUND OR MARKET RUN AGROUND ? LETS WAIT AND SEE WHAT THE NEXT DAY OR TWO BRINGS IT. SOME DECENT NUMBERS IN SEVERAL AREAS HAVE THE PIG THINKING SOMETHINGS AFOOT.

JNN.V.... ANOTHER TURNAROUND ? SIMILAR SCANNING NUMBERS AS OUR PICK ABOVE HAD IT ALMOST TIED FOR SECOND PLACE TONIGHT. AGAIN SOME DECENT NUMBERS BUT SOME LIQUIDITY AND LONGEVITY WOULD BE NICE. A WATCH LIST.....ADDITION.

FAU.V...THE PIG THREW THIS PICK IN TONIGHT AS THERE IS LOTS OF FORUM CHATTER ABOUT ITS POTENTIAL. THE SCANNER COUGHED UP SOME GREAT NUMBERS ON IT EVEN THOUGH ITS A BIT OUT OUR PRICE RANGE. NEVERTHELESS THE PIG FIGURED HE'D THROW IT ON AND LET YOU DECIDE. SOME OF THE THINGS IN THE CHART ARE OBVIOUS......BUT WHEN WAS OBVIOUS A MARKET INDICATOR ? MAYBE NOW ?

VAX.V........................

Galloway Project

The Galloway gold project is located along and to the north of the Cadillac Break in Dasserat Township, less than 30 kilometres west of the Rouyn-Noranda mining district in Abitibi. It can be accessed by road, from Trans-Canada highway 117, 30 km west of Rouyn-Noranda, 65 km east of Kirkland Lake, two mining towns where skilled labor force, drillers and mining services are present.

The Galloway property hosts several gold bearing environments. Two main types of gold mineralization can be observed on the property. The first type is related to veins type gold lode related to ENE or EW striking shear zones that are subsidiaries to the Cadillac-Larder Lake break. This type of mineralization is exemplified by the Francoeur mine. The second type of mineralization is found in the Galloway area. It consists of disseminated pyrite in volcanic and intrusive rocks (syenite). This pyrite carries anomalous gold values (hundreds of ppb’s, up to a few ppm’s) over considerable widths (over hundreds of meters). It has been described by various writers as being related to a porphyry system.

SIGNS, SIGNS, EVERYWHERE THERE'S SIGNS..........

AccelRate president acquires 50,000 shares

2010-06-17 16:46 MT - News Release

Mr. Reimar Koch reports

EARLY WARNING RESPECTING ACCELRATE POWER SYSTEMS INC. NATIONAL INSTRUMENT 62-103 AND MULTILATERAL INSTRUMENT 62-104

Pursuant to sections 5.2(1) and (2) of Multilateral Instrument 62-104 and Appendix E of National Instrument 62-103 on June 16, 2010, Reimar Koch, president and a director of AccelRate Power Systems Inc., acquired ownership and control of 50,000 shares of the company.

Prior to the Acquisition, the Offeror held 430,869 Shares, representing 18.91% of the Company's 5,794,834 outstanding shares. Immediately after the Acquisition, the Offeror held 480,869 Shares, representing 21.22% of the Company's outstanding shares.

The Offeror now owns and controls 480,869 Shares. The Offeror does not have ownership and control of any other securities of the Company, either alone or together with any joint actors. The Offeror does not have ownership of any other securities of the Company, either alone or together with any joint actors, where control is held by persons or companies other than the Offeror or any joint actor. The Offeror does not have exclusive or shared control of any other securities of the Company, either alone or together with any joint actors, without ownership.

The Acquisition was made by private purchase at the price of $0.075 per Share. The market in which the transaction or occurrence which gave rise to this news release took place is the TSX Venture Exchange. The Acquisition was exempt from takeover provisions of applicable securities legislation pursuant to section 4.2 of Multilateral Instrument 62-104, as a private acquisition from not more than five persons for consideration not greater than 115% of the market price of the Shares as at the date of the Acquisition.

The Offeror acquired the Shares for investment purposes. The Offeror intends to acquire ownership of, or control over, additional securities of the Company, also for investment purposes, and has commenced negotiations with the Company in that regard. The Offeror is not a party to any agreement (including any agreement with respect to the acquisition, holding, disposition or voting of any securities) with the Company or any other entity with respect to securities of the Company in connection with the Acquisition. There is no person who may be considered a joint actor of the Offeror in connection with the Acquisition.

There is no person who may be considered a joint actor of the Offeror in connection with the Acquisition.

This is the Offeror's second release under section 5.2 of Multilateral Instrument 62-104. The Offeror previously issued a news release and filed a report under Multilateral Instrument 62-104 in respect of the Company on November 2, 2009. There has been no change in any material fact set out in the previous report filed by the Offeror, except as set out herein.

COMMODITIES

Gold jumps near record on soft US data, rest down

| 2010-06-17 20:25:32 GMT (Reuters) |

* Gold jumps as weak US data/dollar spark safe-haven quest

* Oil, copper down on risk aversion

* Agricultural markets mixed; raw sugar, cocoa slide

By Barani Krishnan

NEW YORK, June 17 (Reuters) - Gold hit near record highs on Thursday while oil and copper fell as soft U.S economic data, a weak dollar and sliding stock markets all combined to drive commodity investors into safe havens.

Agricultural markets, which had rallied sharply in the previous session, ended mixed, with raw sugar losing about 3 percent and cocoa falling 1.5 percent.

The broad decline pushed the 19-commodity Reuters-Jefferies CRB index down 0.3 percent after it rose for four straight sessions to one-month highs on Wednesday.

Analysts cited data showing new U.S. claims for jobless aid rose last week while consumer prices notched their largest decline in nearly 1-1/2 years in May, suggesting interest rates will remain ultra low to nurse the fragile economic recovery.

Separately, factory activity month-to-date in the U.S. mid-Atlantic region braked to its slowest pace in 10 months, heightening fears of slow growth. The dollar slipped while key stock indexes on Wall Street fell more than half a percent by 3:30 p.m. EDT (1930 GMT).

Analysts had expected recovery from the deepest recession since the 1930s to moderate in the second half, but commodities investors took Thursday's weak U.S. data as a sign that gold was the only safe market.

"It's the age-old story, that however illogical it seems, gold is looking for any and every opportunity to go higher, and we all know the reasons why, the safe-haven factor, sovereign debt risks and so on," said Peter Hillyard, head of metals sales at ANZ Investment Bank.

Investors are expected to pore over weekly traders commitment data on gold and other commodities -- due from the U.S. Commodity Futures Trading Commission on Friday -- before deciding moves for the following week, analysts said.

In Thursday's trade, spot gold, which reflects trades in bullion, was bid as high as $1,250.65 an ounce, versus the $1,229.60 level seen in New York late on Wednesday The all-time high for spot gold was $1,251.20.

Gold futures for August settled New York trade up 1.5 percent, or $18.20, at $1,248.70 an ounce. During the session, the contract surged almost 2 percent to reach $1,252.80-- its highest since the record high of $1,254.50.

U.S. oil prices fell just over 1.0 percent. The benchmark front-month crude contract in New York settled down 0.9 percent, or 88 cents, at $76.79 a barrel.

Swollen crude stockpiles, especially at the Cushing, Oklahoma, delivery hub, have kept front-month crude pressured against the next month's contract and also versus Europe's Brent crude benchmark. Brent crude rose on Thursday after a Spanish bond auction bolstered the euro and European stocks.

Copper prices slumped to their lowest in nearly one week, hurt partly by the first inventory build in a month for the metal in exchange-monitored warehouses in London.

U.S. copper's most-actively traded month, July, sank 3.0 percent, or 9.0 cents, to settle at $2.9055 per lb in New York.

In London, benchmark copper also hit a near one-week low at $6,410 a tonne, before ending at $6,446, down $209 on the day.

Latest data shows copper stocks in warehouses monitored by the London Metal Exchange rising 1,025 tonnes to 460,175 tonnes, the first growth of its kind since mid-May. (Editing by David Gregorio)

* Oil, copper down on risk aversion

* Agricultural markets mixed; raw sugar, cocoa slide

By Barani Krishnan

NEW YORK, June 17 (Reuters) - Gold hit near record highs on Thursday while oil and copper fell as soft U.S economic data, a weak dollar and sliding stock markets all combined to drive commodity investors into safe havens.

Agricultural markets, which had rallied sharply in the previous session, ended mixed, with raw sugar losing about 3 percent and cocoa falling 1.5 percent.

The broad decline pushed the 19-commodity Reuters-Jefferies CRB index down 0.3 percent after it rose for four straight sessions to one-month highs on Wednesday.

Analysts cited data showing new U.S. claims for jobless aid rose last week while consumer prices notched their largest decline in nearly 1-1/2 years in May, suggesting interest rates will remain ultra low to nurse the fragile economic recovery.

Separately, factory activity month-to-date in the U.S. mid-Atlantic region braked to its slowest pace in 10 months, heightening fears of slow growth. The dollar slipped while key stock indexes on Wall Street fell more than half a percent by 3:30 p.m. EDT (1930 GMT).

Analysts had expected recovery from the deepest recession since the 1930s to moderate in the second half, but commodities investors took Thursday's weak U.S. data as a sign that gold was the only safe market.

"It's the age-old story, that however illogical it seems, gold is looking for any and every opportunity to go higher, and we all know the reasons why, the safe-haven factor, sovereign debt risks and so on," said Peter Hillyard, head of metals sales at ANZ Investment Bank.

Investors are expected to pore over weekly traders commitment data on gold and other commodities -- due from the U.S. Commodity Futures Trading Commission on Friday -- before deciding moves for the following week, analysts said.

In Thursday's trade, spot gold, which reflects trades in bullion, was bid as high as $1,250.65 an ounce, versus the $1,229.60 level seen in New York late on Wednesday The all-time high for spot gold was $1,251.20.

Gold futures for August settled New York trade up 1.5 percent, or $18.20, at $1,248.70 an ounce. During the session, the contract surged almost 2 percent to reach $1,252.80-- its highest since the record high of $1,254.50.

U.S. oil prices fell just over 1.0 percent. The benchmark front-month crude contract in New York settled down 0.9 percent, or 88 cents, at $76.79 a barrel.

Swollen crude stockpiles, especially at the Cushing, Oklahoma, delivery hub, have kept front-month crude pressured against the next month's contract and also versus Europe's Brent crude benchmark. Brent crude rose on Thursday after a Spanish bond auction bolstered the euro and European stocks.

Copper prices slumped to their lowest in nearly one week, hurt partly by the first inventory build in a month for the metal in exchange-monitored warehouses in London.

U.S. copper's most-actively traded month, July, sank 3.0 percent, or 9.0 cents, to settle at $2.9055 per lb in New York.

In London, benchmark copper also hit a near one-week low at $6,410 a tonne, before ending at $6,446, down $209 on the day.

Latest data shows copper stocks in warehouses monitored by the London Metal Exchange rising 1,025 tonnes to 460,175 tonnes, the first growth of its kind since mid-May. (Editing by David Gregorio)

| ||

|

No comments:

Post a Comment