ON WITH THE SHOW.......

NEED TO OPEN A WINE BOTTLE ?

http://www.wimp.com/wineshoe/MTB.V....THE PIG SAYS GO, THE CHART SAYS GO, THE SENTIMENT, MOVING AVERAGES SCANS ARE OFF SCALE AND NET CAPITAL INFLOW HOLDING STEADY. THE PIG WILL TRY TO GET SOME FOR HIMSELF THURSDAY MORNING. CAN YOU SAY "DOUBLE" ?

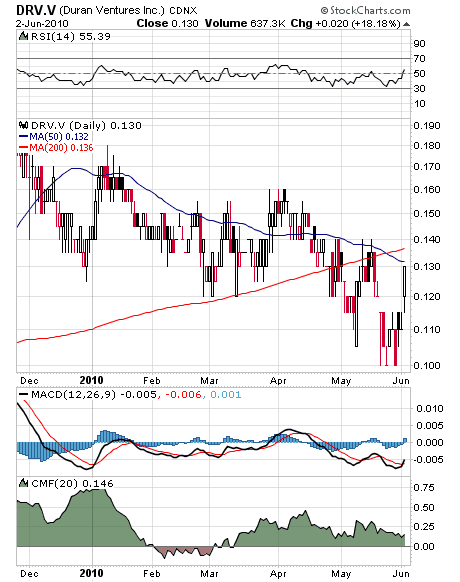

DRV.V....A PREVIOUS PIG PICK AND BIG SCANNER OF THE NIGHT. CONTINUED ACCUMULATION FOLLOWED BY BIG NUMBERS IN VOLUME DISTRIBUTION AND THE AWESOME "GOLDEN CROSS" IN THE MOVING AVERAGES. LOOKS LIKE FINALLY AN UPTREND OF SIGNIFICANCE IS IN THE OFFING.

UVR.V........THIS ONES BEEN ON THE PIGS RADAR FOR A COUPLE OF WEEKS, NEVER ABLE TO CRACK THE TOP 5 OR 3....UNTIL NOW. SIGNIFICANT ACCUMULATION, ANOTHER "GOLDEN CROSS" ON THE MOVING AVERAGES, UPTURNS IN THE RSI AND MOMENTUM VECTORS. THE PIG SAYS THIS ONES DUE FOR A MOVE, JUST WHEN IS THE QUESTION, THE PUMP IS PRIMED.

Why People Don’t Trust Free Markets

The new science of evolutionary economics offers an explanation for capitalism skepticism

In his magnum opus on the power of free markets, Human Action, the Austrian economist Ludwig von Mises noted: “The truth is that capitalism has not only multiplied population figures but at the same time improved the people’s standard of living in an unprecedented way. Neither economic thinking nor historical experience suggest that any other social system could be as beneficial to the masses as capitalism. The results speak for themselves. The market economy needs no apologists and propagandists. It can apply to itself the words of Sir Christopher Wren’s epitaph in St. Paul’s: Si monumentum requires, circumspice.” If you seek his monument, look around.Capitalism may not need apologists and propagandists, but it does need a vigorous scientific and rational defense as evidenced by the fact that so many people still distrust free markets. Market solutions to social problems are generally received with skepticism. Businessmen are distrusted, corporations looked at askance, and there is a well-known resentment against those who have most benefited from markets. (As one New Yorker cartoon featuring two people in conversation reads: “I hated Bill Gates before it became so fashionable.”) Why do people distrust free markets?

Part of the answer can be found in our history. Because we lived for so long in small groups of a couple of dozen to a couple of hundred people in hunter-gatherer communities in which everyone was either genetically related or knew one another intimately, most resources were shared, wealth accumulation was almost unheard of, and excessive greed and avarice was punished. Thus, we naturally respond to a free market system in which conspicuous wealth is paraded as a sign of success with envy and anger. Call it evolutionary egalitarianism.

Throughout most of the history of civilization as well, economic inequalities were not the result of natural differences in drive and talent between members of a society equally free to pursue their right to prosperity; instead, a handful of chiefs, kings, nobles, and priests exploited an unfair and rigged social system to achieve gains best described as ill gotten.

People also have a remarkably low tolerance for economic ambiguity. Free markets are chaotic and uncertain, uncontrollable and unpredictable. Most of us have little tolerance for such environments, and we have learned to expect that social institutions such as the government will bring a level of certainty to society. People who cannot afford (or who choose not to purchase) insurance against acts of God typically expect acts of government to save them.

As well, there is well-documented liberal bias in the academy and the media against free markets. A 2005 study by the George Mason University economist Daniel Klein, for example, found that at two of America’s leading institutes of higher learning Democrats outnumbered Republicans among the faculty by a staggering ratio of 10 to 1 at the University of California, Berkeley and by 7.6 to 1 at Stanford University.

Measuring political attitudes through voter registrations among faculty in twenty different departments, in the humanities and social sciences the ratio was 16 to 1 at both campuses (30 to 1 among assistant and associate professors), and in some departments, such as anthropology and journalism, there wasn’t a single Republican to be found.

In another 2005 study on “Politics and Professional Advancement Among College Faculty,” Stanley Rothman, S. Robert Lichter, and Neil Nevitte discovered that only 15 percent of those teaching at American colleges and universities describe themselves as conservative while 72 percent said they were liberal, and that figure climbed to 80 percent in such departments as English literature, philosophy, political science, and religious studies, with only five percent labeling themselves as conservative.

In a 2005 publication in the Georgetown Law Journal, Northwestern Law Professor John McGinnis reviewed the faculties of the top 21 law schools rated by the 2002 U.S. News & World Report graduate-school rankings and found that politically active professors at these top law schools overwhelmingly tend to be Democrats — 81 percent contributed “wholly or predominantly” to Democratic campaigns while just 15 percent did the same for Republicans.

In a manner and potency matching academia, the bias in the media is against free market economics. A comprehensive 2005 study conducted by UCLA political scientist Tim Groseclose and University of Missouri economist Jeffrey Milyo, published in the Quarterly Journal of Economics, measured media bias by counting the times that a particular media outlet cited various think tanks and policy groups, and then compared this with the number of times that members of Congress cited the same groups. “Our results show a strong liberal bias: all of the news outlets we examine, except Fox News’ Special Report and the Washington Times, received scores to the left of the average member of Congress.” Not surprisingly, the authors discovered that CBS Evening News and the New York Times “received scores far to the left of center” and that “the most centrist media outlets were PBS NewsHour, CNN’s Newsnight, and ABC’s Good Morning America.” Interestingly, USA Today — that ne plus ultra of pop print media — was closest to political center of all newspapers.

The strongest reason for skepticism of capitalism, however, is a myth commonly found in objections to both the theory of evolution and free market economics, and that is that they are based on the presumption that animals and humans are inherently selfish, and that the economy is like Tennyson’s memorable description of nature: “red in tooth and claw.” After Charles Darwin’s The Origin of Species was published in 1859, the British philosopher Herbert Spencer immortalized natural selection in the phrase “survival of the fittest,” one of the most misleading descriptions in the history of science and one that has been embraced by social Darwinists ever since, applying it inappropriately to racial theory, national politics, and economic doctrines. Even Darwin’s bulldog, Thomas Henry Huxley, reinforced what he called this “gladiatorial” view of life in a series of essays, describing nature “whereby the strongest, the swiftest, and the cunningest live to fight another day.”

If biological evolution in nature, and market capitalism in society, were really founded on and sustained by nothing more than a winner-take-all strategy, life on earth would have been snuffed out hundreds of millions of years ago and market capitalism would have collapsed centuries ago.

This is, in fact, why WorldCom and Enron type disasters still make headlines. If they didn’t — if such corporate catastrophes caused by egregious ethical lapses were so common that they were not even worth covering on the nightly news — free market capitalism would implode. Instead it thrives, but just as eternal vigilance is the price of freedom, so too must it be for free markets, since both are inextricably bound together.

| |

| There are 55 plants under construction worldwide One of the predictions we’ve been making over the last while is lots of volatility and we can see that continuing over the coming months. Take yesterday for instance, bad economic news about debt and the economy out of Europe—the markets get smashed. Then good economic news out of the United States—and boom, the markets soar! Don’t like the markets at the moment? Wait ten minutes. There are two sectors of the market that are so dirt-cheap (natural  change for the sector. Is it six weeks? Is it six months? Or for that matter, is it six years? But so many natural gas and uranium stocks are so dirt cheap, if one could figure out when those sectors move, I suspect there are big rewards down the road. Yesterday in the Hard Rock Analyst the Coffin Brothers took a look at the uranium sector and they wrote, “Last Thursday morning brought news from a couple of companies we are following in the much beleaguered uranium space...The on-going nightmare of oil surging into the Gulf of Mexico from BP’s deep sea well is shutting down the potential for expansion offshore US oil output. This will be a serious blow to domestic US oil production since most on-shore sources have been tapped already, but at this point it isn’t clear its impact on global supply will be overwhelming. Certainly it is causing a rethink of how to best to generate power for the modern economy. We think uranium generation could benefit from that, if only by reminding that no form of energy generation is without risk or some degree of landscape altering activity. The small footprint from uranium power plants may be viewed as balancing the risk of handling a radioactive material. If sentiment turns in favour of expanded uranium use the first impact will be on the metal’s price.” So the Coffin Brothers write. We should point out that in countries that seem to need lots of lawyers to get uranium facilities built like the United States, it can 11 to 14 years to get nukes built. In places where there is not the input and the problem of lawyers like India, it’s a mere four years to get a nuke built. We wonder if the fuel of choice for generation of power down the road isn’t going to be natural gas where you can buy facilities off the shelf and they only take 2 years to be built. Interesting! |

No comments:

Post a Comment